TERMS OF SERVICE

Last Updated: February 24th, 2023

1. INTRODUCTION

Welcome to Apex Card Services, LLC., wholly owned and operated by ZenChip PRIME Corp. d/b/a Apex Card Services, LLC. (“Apex Card Services, LLC.,” “we,” “us”, or “our”). And a third party compliance firm known as These Terms of Service (“Terms”) (“TOS”) govern your access to and use of the Apex Card Services, LLC. website(s), our APIs, mobile app (the “App”), and any other software, tools, features, or functionalities provided on or in connection with our services; including without limitation using our services to view, explore, and create NFTs and use our tools, at your own discretion, to connect directly with others to purchase, sell, or transfer NFTs on public blockchains (collectively, the “Service”). “NFT” in these Terms means a non-fungible token or similar digital item implemented on a blockchain (such as the Ethereum blockchain), which uses smart contracts to link to or otherwise be associated with certain content or data. For purposes of these Terms, “user”, “you”, and “your” means you as the user of the Service. If you use the Service on behalf of a company or other entity then “you” includes you and that entity, and you represent and warrant that (a) you are an authorized representative of the entity with the authority to bind the entity to these Terms, and (b) you agree to these Terms on the entity’s behalf.

PLEASE READ THESE TERMS OF SERVICE CAREFULLY AS THEY CONTAIN IMPORTANT INFORMATION AND AFFECT YOUR LEGAL RIGHTS. AS OUTLINED IN SECTION 16 BELOW, THEY INCLUDE A MANDATORY ARBITRATION AGREEMENT AND CLASS ACTION WAIVER WHICH (WITH LIMITED EXCEPTIONS) REQUIRE ANY DISPUTES BETWEEN US TO BE RESOLVED THROUGH INDIVIDUAL ARBITRATION RATHER THAN BY A JUDGE OR JURY IN COURT. BY CLICKING TO ACCEPT AND/OR USING OUR SERVICE, YOU AGREE TO BE BOUND BY THESE TERMS AND ALL OF THE TERMS INCORPORATED HEREIN BY REFERENCE. IF YOU DO NOT AGREE TO THESE TERMS, YOU MAY NOT ACCESS OR USE THE SERVICE.

These Terms and Conditions apply to Your Apex Card Services multi-currency account which is an electronic-money (E-Money) account issued in the United Kingdom (UK). This Agreement is between Nvayo Limited (060352009) and You. If You are a Cardholder (as defined below), these Terms and Conditions shall also apply to Your Apex Card Services Payment Card which is powered by Mastercard. In this Agreement, Your Apex Card Services E-Money account and Your Apex Card Services Payment Card may be individually or collectively referred to as the “Accounts” You must read these terms and conditions carefully. By using Your Membership and/or Accounts, You will be deemed to have accepted these Terms and Conditions. If You do not accept these Terms and Conditions, You should not use Your Accounts. If You have any questions, please contact Your Apex Card Services Member Support team (see details below).

2. ABOUT YOUR ACCOUNT

Your accounts are not transferable. These accounts are issued under the laws of England and Wales. This Agreement and Your Accounts are operating in the UK and these terms shall be governed by and construed under and in accordance with English law. We may amend or change the terms and conditions of this Fee Schedule at any time. We may cancel or suspend Your Account or this Fee Schedule and any related agreements at any time at our sole discretion. Your Accounts are issued by and are the property of Nvayo Limited, a company incorporated in England & Wales with company number 06035209 whose registered office is at 1 King William Street, London, EC4N 7AF, UK. Nvayo Limited is authorized by the Financial Conduct Authority under the UK Electronic Money Regulations 2011, reference number 900005, for the issuance of electronic money and the provision of payment services. When referring to “Nvayo”, “We”, “Our” or “Us” this is considered to mean Nvayo Limited. All monies funded to Your Accounts are held in segregated custodial pooled accounts on Your behalf at one of Nvayo’s banking partners and can be redeemed at any time upon request for the current monetary value held, subject to our fees, local laws, and exchange regulations. The Accounts are held for the purposes described in this Agreement which includes account funding, payments, card purchases, adjustment of balances for corrections, Account Transactions, fees, and other actions described herein. We may offer You Accounts in different currencies, including USD, EUR, GBP, JPY, or CNY. Some currency Accounts may not be available to You. You agree that We may add or discontinue the use of any currency at any time. For more information about using Your Account, account features, and account limitations, please refer to apexcardservice.com

SECTION 2: DEFINITIONS

For the purpose of this Agreement, the following terms have the meanings specified below: Accounts: Means the E-Money Accounts issued by Nvayo Limited to You in the form of a virtual Account under this Agreement. No interest will accrue or be paid in respect of funds on Your Account. The funds in Your Account are not insured. Agreement: Means these terms and conditions together with the Fee Schedule, any supplementary terms and conditions, and amendments to them that We may notify You of from time to time.

Business Day: Means a day other than Saturday or Sunday or a Bank holiday in the United Kingdom on which clearing banks are open for business.

Card: Means the Branded Apex Card Services Payment Card powered by Mastercard under The Apex Card Services / AU Membership Agreement, which accesses the funds within the Accounts.

Cardholder: Means the person who is legally entitled to receive an Apex Card Services branded card pursuant to the terms of the Apex Card Services, AU Membership

Agreement. Club: Means Apex Card Services Club Membership. Apex Card Services Membership Agreement: means the Apex Card Services Membership Agreement signed and agreed by You at the time of establishing a business relationship. You can find the up-to-date version of this Agreement at: https://apexcardservice.com/policies/

Mastercard: Means Mastercard International incorporated in New York or its successors or assigns.

Membership: Means the Apex Card Services Membership Agreement.

Transaction: Means any transfer, foreign exchange trade, account funding or payment completed by You using Your Accounts, or any action which alters the balance of Your Account.

Website: Means www.apexcardservice.com You/Your: Means the physical person entering and agreeing to these Terms and Conditions with Us.

SECTION 3: GENERAL

Your Account is part of Your Apex Card Services Membership (apexcardservices.com/policies/) and subject to the terms of the agreement between You and Apex Card Services. By using the Account, You expressly authorize Nvayo and its appointed service providers to transfer funds from Your Account to an account operated by Apex Card Services, LLC. for payment of services you have ordered from “The Card Service”.

If Your Membership with Apex Card Services Membership Club is terminated pursuant to:

(i) the terms of Section 14 of this Agreement, or

(ii) Apex Card Services Membership Agreement, We will automatically close Your Account and send the remaining balance to an account You nominate less any fees You owe us and subject to any applicable regulatory provision. An Administrative Fee may be assessed against Your Account prior to closing. You may transfer money between Your Accounts at an exchange rate determined by us at the time of the transfer. You may use Your Account to transfer to another Club members Account and to make payments by electronic bank transfer to another person or business. For security reasons, We may limit the amount or number of Transactions You can make on Your Accounts or request additional information for the purpose of Transactions. Your Accounts cannot be redeemed for cash, unless otherwise available at an ATM. If We believe that You’ve engaged in any of activities that we deem to be illegal, We have the right to take a number of actions to protect Nvayo and its affiliates, its customers, and others at any time in our sole discretion.

The actions We may take include but are not limited to the following:

(i) Freeze and/or close Your Account,

(ii) Request additional information or clarification concerning the Transaction.

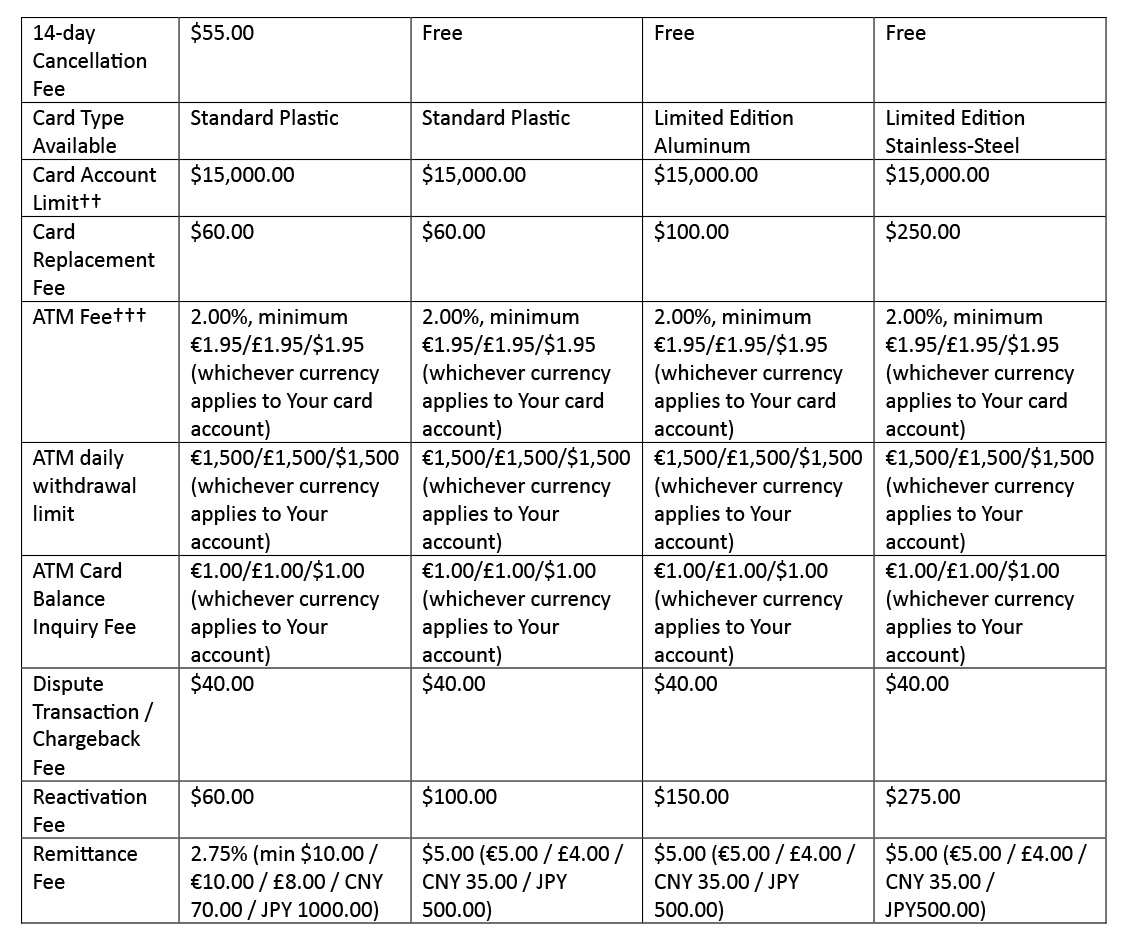

SECTION 4: FEES

In addition to the Fee Schedule outlined in Schedule 1, please refer to Your Apex Card Services Membership Agreement for more information regarding an additional list of fees associated with Your Membership. Your use of Your Accounts is subject to the fees and charges set out in the Fee Schedule (“Fees”) and in other applicable fees as set out in Your Apex Card Services Membership Agreement. These Fees are part of this Agreement. Any or all of these Fees may be waived or reduced at our discretion. The Fees may change over time, if so, We will notify You in advance of such changes in accordance with Section 1. Fees will be paid from Your Accounts at such time they are incurred. All fees are calculated in USD. If You initiate a Transaction or hold an Account with a different currency, We will convert such fees under the applicable rates, unless otherwise indicated in the Fee Schedule. The currency of the Account from which the Transaction is originating and applied to Your account is the same currency as the Transaction to which they relate. If a fee cannot be attributed to a single currency, it will be applied or converted to Your USD Account. Foreign exchange fees may apply. If there are no funds or insufficient funds for a calculated fee, then We may partially deduct any of Your Account (including but not limited to Your fiat wallet account to satisfy amounts owed. Section 3.2 above and the provisions regarding overspend on Your Account(s) will also apply.

SECTION 5: IDENTIFICATION REQUIREMENTS

The information We collect from You can include Your name, physical address, phone number, electronic email address, date of birth, taxpayer ID number, national ID, a self-portrait photograph, bank account information, credit card information, etc. You agree to provide us with the information We request for the purpose of identity verification and to comply with regulations and our policies regarding anti-money laundering, terrorist financing, fraud, or any other financial crime. To verify Your identity, We may use our service providers, digital tools and other electronic records and national databases to obtain a positive match of legal name and address. Sometimes finding Your information using national databases does not work because the information is unavailable, or Your name or address has changed. If We cannot verify Your personal information, We will ask You to send us documentation through to our customer onboarding team that confirms Your identity. A list of documents that meet our identification requirements will be provided at the time of Account opening and may change from time to time at Nvayo’s sole discretion. These are examples of the documents You will need to provide to confirm Your identity prior to opening an Account with Us:

Accepted Forms of Proof of Identity POI:

1. Passport ID Page or Passport Card, unexpired.

2. National, State or Government issued Identity Card, unexpired.

3. Driving License, unexpired.

Accepted Forms of Proof of Address POA:

1. Utility Bill dated within the last 3 months.

2. Bank Statement dated within the last 3 months.

3. Court or Governmental documents including Your address. You agree to meet identification requirements to complete account funding, transfer or payment Transactions as may be required from time to time. We may also request You to provide information regarding Your overall source of wealth and the source of the funds We will be receiving in compliance with our policies and procedures. You agree to provide accurate and complete information and/or documentation to meet this purpose. Although no credit history is required to obtain an Account, You authorize us to obtain information about You from time to time from credit reporting agencies and other third parties for our internal processes including information and documentation regarding Transactions.

SECTION 6: THESE TERMS AND CONDITIONS

We may change these Terms & Conditions at our sole discretion including without limitation changing existing Fees or introducing new Fees, from time to time by providing You with at least 60-day notice unless We are required to make such a change sooner by law or if changes are made for security purposes. Nonetheless, We may implement new payment services from time to time without notice. All such changes will be posted on our Website and such other means that We agree with You. The up-to-date version of these Terms and Conditions will be posted on the Website. You should check the Website regularly so that You can see the latest version. You agree to be bound by these Terms and Conditions and any amendments made to them by using Your Accounts.

We recommend that You print off a copy of these Terms and Conditions to keep for Your records for reference purposes. You will be taken to have accepted any change We notify to You unless You tell us that You do not agree to it prior to the relevant change taking effect. In such circumstances, We will treat Your notice to us as notification that You wish to terminate this Agreement immediately and We will refund the balance on Your Account subject to our redemption conditions. These Terms and Conditions govern Your use of Your Accounts. The funds for all Transactions are held in Your Account and no interest will be paid on these. When You make a Transaction using Your Account the value of the Transaction plus any associated Fees payable will be deducted from Your Account and used to complete the Transaction. Your Accounts are E-money Accounts and the funds added onto Your Accounts are known as electronic money. Your Account is not a credit facility or a charge account. You can only spend the value of the funds in Your Accounts. Although our activities are regulated by the Financial Conduct Authority (UK), Your Account is not covered by the Financial Services Compensation Scheme. However, the funds in Your Account are safeguarded by us, which means that they are kept separate from our assets so in the unlikely event We become insolvent, Your funds remain safe from our creditors.

SECTION 7: ACCOUNT ISSUANCE

To use the Accounts, You must be of legal age or at least 18 years of age. Accounts are non-transferable and non-assignable by You. Before We can issue You an Account, We will need to know some information about You as set forth above. We will check Your identity, where You reside, and We may also ask information about Your source of wealth and funds. We may use third parties to obtain this information and carry out checks on our behalf, this may include using credit reference agencies. However, a credit check is not performed, and Your credit rating will not be affected. We reserve the right to refuse to issue You an Account or terminate Your Accounts at any time for any reason or no reason, without penalty. If You have any problems with Your Accounts, please contact the Apex Card Services Member Support Team. It may not be possible to use Your Accounts until contact has been made.

SECTION 8: FUNDING YOUR ACCOUNTS

Limits may apply to the number of times Your Accounts may be funded in a day or other period of time. Minimum and maximum funding limits may also apply. Limits may vary depending on Your Membership level. We reserve the right to refuse to accept any particular load or funding Transaction. If a funding Transaction breaches the load limit, We may be able to accept the Transaction only if You can satisfy the enhanced due diligence requirements of providing satisfactory documentation as to source of funds, the nature of the Transaction and other documentation which may be requested. Funds may be transferred to Your Accounts if instructed by You. If You notice a payment out of Your Accounts that You did not authorize, You should contact us immediately. You should be aware that deliberately making a false claim that a payment was unauthorized is fraud. We may notify You when other methods of funding become available. Fees may apply to all funding methods. We reserve the right to change or waive any funding fees at any time at our sole discretion. We will credit funds received via bank transfer, cards, and/or alternative payment methods. We accept, to the Club Account as designated by You and per the applicable funding instructions. If funds received into one of Your Accounts are not of the same currency, We will convert the funds using the current exchange rate, less any applicable fees, and credit Your Account. You may not fund Your Accounts by sending cash or a cheque directly to Club or Nvayo Limited. For more information on funding Your Account, contact the Apex Card Services Member Support Team (see details below) You should keep track of the amount funded to Your Account.

You may view Your balance at any time by using the Club mobile application or by visiting the Website. If You have questions about Your balance or spot something that may not be correct, please contact the Apex Card Services Member Support Team using the Contact Us information in the mobile application or on the Website. You may add funds to Your Card account at any time by transferring funds from one of the currency wallets in Your Account. Your Card does not allow You receive cash over the counter or cash back when You make a purchase with Your PIN, this restriction is a security and personal safety feature of the Card. Restrictions may apply. All balances in Your Accounts are definitely and finally determined by us based solely in our records.

SECTION 9: USE OF YOUR ACCOUNTS

We make Your funds available in accordance with applicable laws and regulatory requirements, banking partners and availability of funds from institutional networks. Funds may take several days to appear in Your account depending upon 3rd parties involved in the transfer and Your provision of substantiating documentation of the funds. Your Accounts should be treated as “cash” and therefore it is Your responsibility to keep all Account information safe. Payments can be instructed from any currency Account You hold with us. Each time You use Your Accounts, You authorize us to reduce the value available on Your Accounts by the amount of the Transaction plus applicable fees. Funds in Your Accounts may be transferred to a bank account able to receive electronic bank transfers or another Club Account. To move money from Your Account via a bank transfer, You must submit a Transaction request using the mobile application or website. Funds in Your Account are not available to spend directly to a merchant or online. However, You can use Your Card to purchase goods and services at select merchants where Mastercard is accepted. You can also withdraw cash over the counter at a financial institution or at select ATM’s displaying the Mastercard logo, subject to there being sufficient funds in Your Card and the Merchant, or financial institution being able to verify this online. You are personally liable and responsible for all Transactions initiated and Fees incurred using Your Accounts. You must not give information about Your Account to anyone else to use. If You permit another person to have access to Your Account You will be deemed to have authorized that person to use Your Account and agree that You are personally liable for the use of Your Accounts, according to these Terms and Conditions. Be aware that some financial providers (for example banks) charge additional fees for the use of their services. You may also be subject to their terms and conditions of business. It is Your responsibility to check before proceeding with Your Transaction. We reserve the right to decline or delay any Transactions at our sole discretion. We may request additional documentation concerning any Transaction regarding the nature and parties involved in the Transaction. If We refuse to authorize or delay a Transaction, We may, if practicable, tell You why immediately unless it would be unlawful for us to do so. You may correct any information We hold, and which may have caused us to refuse or delay a Transaction by contacting the Apex Card Services Member Support Team. /

WE SHALL NOT BE LIABLE IF A FINANCIAL INSTITUTION REFUSES TO ACCEPT YOUR TRANSACTION OR IF We DO NOT AUTHORISE A TRANSACTION, OR IF We CANCEL OR SUSPEND USE OF YOUR ACCOUNTS. UNLESS OTHERWISE REQUIRED BY LAW, We SHALL NOT BE LIABLE FOR ANY LOSS OR DAMAGE YOU MAY SUFFER AS A RESULT OF YOUR INABILITY TO USE YOUR ACCOUNTS FOR A TRANSACTION.

You must not spend more money on Your Accounts than You have in Your Accounts. You are responsible for ensuring that You have sufficient funds when You authorize a Transaction. If this occurs, You must pay the overspend to us immediately. We may offset the amounts You owe us against any of Your Accounts. We will take any such action seriously and take any steps necessary to enforce any actions against You. We reserve the right to suspend or terminate Your Accounts if Your Account balance is negative. All Transactions/wire transfers are final. You do not have the right to stop a payment or transfer Transaction originated by use of Your Account, all transfers are final. If You use Your Card number without presenting Your Card (such as for a mail order, telephone, or Internet purchase), the legal effect will be the same as if You used the Card itself. For security reasons, We may limit the amount or number of Transactions You can make on Your Card. Your Card cannot be redeemed for cash. You may not use Your Card for any illegal Transaction. Each time You use Your Card, You authorize us to reduce the value available on Your Card by the amount of the Transaction plus applicable fees.

WE ARE NOT RESPONSIBLE OR LIABLE IN ANY MANNER FOR PURCHASES, RESERVATIONS, BOOKINGS, TRAVEL OR ANY OTHER GOODS AND/OR SERVICES PURCHASED WITH THE USE OF THE CARD REGARDLESS OF THE PURCHASE AMOUNT.

We will not refund Your money for faulty, undelivered, or otherwise inadequate goods or services purchased using the Card. All such disputes must be addressed directly with the merchant providing the relevant goods or services. Purchases made through the personal concierge/butler service are not guaranteed or covered for inadequate service under the Card.

You may send a Remittance from your Account to domestic and international recipients. A Remittance originates from Your Account and is transferred to an external third party using the Visa or MasterCard networks. Remittance transactions will be charged to Your fiat wallet in your Account that you select to initiate the Transaction. We may charge for Remittance Transactions as included in the Fee Schedule (Schedule 1). You must have sufficient balance in the selected wallet equivalent to the value of the Remittance plus any Fees. We are not obliged to process any particular Remittance transaction. When You submit a Remittance transaction, You are requesting that We process such Transaction on your behalf. We may, in our absolute discretion, refuse or stop any Remittance Transaction from certain senders or to certain recipients. We may, at our discretion, limit the number or value of Remittance Transactions you are permitted to send from your Account. You agree to provide Us with true, accurate, current, and complete information when you initiate a Remittance Transaction. A Remittance Transaction is subject to the timely confirmation from Remittance beneficiary.

You agree to only use transfer features with people or merchants that you know. You agree that You should not transact with people or merchants You do not know and that We offer no protection for authorized payments for goods and services. You agree that You may not use the Remittance Transactions for fraudulent or illegal purposes, to facilitate illegal or fraudulent Transactions or in connection with the use of illegitimate funds.

Your use of these transfers for the purchase of goods or services is potentially high risk, We do not evaluate all providers of goods and services, and We do not protect you if the goods or services are non-conforming, damaged, or not what you paid for or expected. We will attempt to process Remittance Transactions promptly, but any Transaction may be delayed or cancelled for a number of reasons or limitations, for which We will not be liable to You. Remittance may not be available in whole or in part in certain regions, countries, or jurisdictions. Certain destinations may impose taxes, fees, or foreign exchange charges upon the receiver’s receipt of, or access to, the transfer.

PLEASE SEE SECTION 13 OF THIS AGREEMENT FOR MORE INFORMATION ABOUT OTHER DISCLAIMERS AND OUR LIABILITY WHEN YOU USE YOUR ACCOUNTS. We reserve the right to modify or discontinue Remittance Transactions at any time at our sole discretion.

SECTION 10: TRANSACTIONS MADE IN FOREIGN CURRENCIES

If You use Your Accounts for a Transaction in a currency other than the currency of the Account from where You initiate the Transaction, We will convert the Transaction to the target currency at a rate determined by us. We will provide You with a quote for the conversion of foreign currency and You must accept the quote prior to us accepting the Transaction for processing. The rate used to complete the Transaction and other fees charged will appear in Your Account statement. If You use Your Card to purchase goods or services or withdraw cash in a currency other than the currency of Your Card, then such Transaction will be converted to the currency of Your Card on the day We receive details of it. We will use Mastercard authorized rates applicable for such a Transaction available at the website below. A foreign exchange fee will also apply: https://www.mastercard.com/global/currencyconversion. Please refer to the Foreign Exchange (FX) Disclosure Notice below. FX Disclosure Notice: To the extent that clients enter into FX Transactions with Nvayo Limited, it will be on the basis of the terms provided in this Disclosure Notice and other supplementary information as provided by Nvayo Limited. This FX Disclosure Notice is not intended to conflict with or override any relevant law, regulatory rule, or other applicable requirement in any jurisdiction in which Nvayo Limited conducts business. The Exchange Rate is the rate We use to convert is based on the foreign currency market for each currency We offer, so it changes constantly. Unless otherwise disclosed, Nvayo Limited will generally provide an exchange rate with a single “all-in” price included in the fee schedule provided in this agreement and other applicable terms.

The price, costs and sales margin will vary depending on the Membership tier and the Transaction. The inclusion of costs and/or sales margin will apply to requests for quotes and orders. We reserve the right to make changes to this FX Disclosure Notice and its components at any time. We will notify You of any changes on this FX Disclosure Notice and other relevant changes regarding currency exchange availability, fees, pricing, methodology, etc. Nothing in this FX Disclosure Notice is to be construed as an offer for services or products, nor should it be construed as financial, legal, regulatory, tax, accounting, or other advice to enter into any Transaction. This FX Disclosure Notice has no regard to the specific financial situations or particular needs of any client or prospective client. Therefore, clients or prospective clients should make their own independent assessment of this FX Disclosure Notice and obtain independent professional advice before taking any actions on the basis of this FX Disclosure Notice.

SECTION 11: DISPUTED TRANSACTIONS

You may be entitled to claim a refund in relation to Transactions made using Your Account where:

(i) We are responsible for a Transaction which was incorrectly executed by us and You notified to us in accordance with the terms of these Terms and Conditions;

(ii) We were notified in writing of the unauthorized/incorrectly executed Transaction immediately, or unless otherwise notified per applicable law. All refunds, if any, are at our sole discretion.

You can also ask us to investigate the Transaction or misuse of Your Accounts. We may need more information and assistance from You to carry out such an investigation. If We elect to refund a disputed Transaction to Your Account and subsequently receive information to confirm that the Transaction was authorized by You and correctly posted to Your Account, We shall deduct the amount of the disputed Transaction from the funds in Your Account. If there are no funds or insufficient funds, then the provisions regarding overspend on Your Account will apply. If our investigations discover that the disputed Transaction was genuine and authorized by You directly or indirectly, or that You have acted fraudulently or with gross negligence, We may charge You an investigation fee (see the Fee Schedule for details). You should get a receipt at the time You make a Transaction or obtain cash using Your Card.

SECTION 12: KEEPING YOUR ACCOUNT SAFE

You must keep Your Accounts number, log-in credentials, and information safe. Your Account number and information is personal to You and You must not give it to anyone else to use. You must take all reasonable precautions to prevent fraudulent use of Your Account. Similar to bank account numbers, the Account number must be kept secure. If You disclose it to any third party, it is done at Your own risk. You also agree that You alone are responsible for taking necessary safety precautions to protect Your own account and personal information. If You suspect that someone else knows Your Account credentials, LET US KNOW IMMEDIATELY. If You receive a Card, You will receive a Personal Identification Number (PIN) for Your Card and You must keep Your PIN safe. This means that when You receive Your PIN You must memorize it and You must keep Your PIN secret at all times. You must not disclose Your PIN to anyone DO NOT WRITE YOUR PIN OR CARRY IT ON YOUR PERSON. To change Your PIN log on to Your account and follow the instructions. To ensure the PIN is synchronized with Your chip, You have to go to a Mastercard chip enabled terminal or ATM so the system can update. If You forget Your PIN, You can access it when You log on to Your Card Account or call in. We strive to maintain the safety of Your funds entrusted to us and have implemented industry standard protections for our services. However, there are risks that are created by individual user actions. You agree to consider Your access credentials such as username and password as confidential information and not to disclose such information to any third party. You shall be solely responsible for the safekeeping of Your Accounts and password on Your own, and You shall be responsible for all activities under Accounts. We will not be responsible for any loss or consequences of authorized or unauthorized use of Your Account credentials including but not limited to information disclosure, information posting, consent to or submission of various rules and agreements by clicking on the website, online renewal of agreement, etc., for Your actions, inactions, or omissions. By creating an Account, You hereby agree that: (i) You will notify us immediately if You are aware of any unauthorized use of Your account and password by any person or any other violations to the security rules; (ii) You will strictly observe the security, authentication, dealing, charging, withdrawal mechanism or procedures of the website/service; and (iii) You will log out from the website by taking proper steps at the end of every visit. If Your Card is reported lost or stolen, We will cancel it and may issue a new one. Fees may apply. If You find Your Card after You have reported it lost, stolen, or misused, You must destroy it and inform Us immediately. We may enable security features from time to time to authenticate Transactions when You use Your Card for online purchases. When you use your card at participating 3D Secure (3DS) online merchants, We will automatically generate and send an On-Time Password to the mobile phone number you registered with Us to help Us authenticate that the transaction is genuine. This feature is only applicable when You have a valid mobile number registered with Us. You will need to enter the OTP to complete Your Transaction. The password is valid for a limited period of time and only for one Transaction, on a computer system or other digital devices with connection to the internet. The OTP will only be sent to the mobile number in Our records after You have started or conduct an online Transaction. If there is a change in Your mobile number or You have not registered Your phone with Us, please update Your contact details with Us pursuant to the Customer Services section below. Only participating merchant websites will ask for an OTP for authentication purpose and You will not be able to complete a Transaction without an OTP. If You are unable to provide Your OTP, or if Your authentication otherwise fails, the merchant may not accept Your Card in payment for that Transaction. You agree that the sending of any SMS by Nvayo and/or its receipt by You may be delayed or prevented by factor(s) outside of Nvayo’s control. You agree that neither Nvayo nor its service provider shall be liable in any way for any merchant’s refusal to accept Your Card in a payment for that Transaction, regardless of what the reasons may be. You understand that use of the 3DS does not, in any way, indicate that we recommend or endorse any merchant, regardless of whether the merchant requires the OTP. If the merchant website has not enabled this 3DS feature, You will not be asked for an OTP. You will still be able to purchase online from merchant websites that do not participate in 3DS. We reserve the right to modify, discontinue (temporarily or permanently) 3DS with or without notice to You. Other restrictions and mobile service provider conditions may apply. If You are overseas or using overseas mobile service providers, the service provider may not support international SMS. PLEASE SEE

SECTION 13.1 BELOW FOR MORE INFORMATION ABOUT OTHER DISCLAIMERS AND OUR LIABILITY WHEN YOU USE YOUR CARD.

SECTION 13: LIABILITY

EXCEPT AS EXPRESSLY SET FORTH IN THIS AGREEMENT, THE SERVICES TO BE PROVIDED UNDER THIS AGREEMENT ARE FURNISHED AS IS, WHERE IS, WITH ALL FAULTS AND WITHOUT WARRANTY OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING ANY WARRANTY OR MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE. WE ACCEPT NO RESPONSIBILITY FOR ANY DELAY IN ONWARD TRANSACTIONS ATTRIBUTED TO THE LATE ARRIVAL OF FUNDS OR INSTRUCTIONS OF TRANSACTIONS RELATIVE TO THE CUT OFF TIMES OF BANKS OR FOR DELAYS FOR FAULTS DUE TO THIRD-PARTIES OR BANKING SYSTEMS. WE ARE NOT RESPONSIBLE FOR BANKING CHARGES.

We reserve the right to charge You for any reasonable costs that We incur in taking action to stop You using Your Accounts and to recover any monies owed as a result of Your activities.

OUR LIABILITY TO YOU UNDER THESE TERMS AND CONDITIONS SHALL BE SUBJECT TO THE FOLLOWING EXCLUSIONS AND LIMITATIONS. We WILL NOT BE LIABLE FOR ANY LOSS ARISING FROM: ANY CAUSE WHICH RESULTS FROM ABNORMAL OR UNFORESEEN CIRCUMSTANCES BEYOND OUR REASONABLE CONTROL OR WHICH WOULD HAVE BEEN UNAVOIDABLE DESPITE ALL OUR EFFORTS TO STOP IT, OR US SUSPENDING, RESTRICTING OR CANCELLING YOUR ACCOUNT IF We SUSPECT AT OUR SOLE DISCRETION THAT YOUR ACCOUNT IS BEING USED IN AN UNAUTHORISED, ILLEGAL OR FRAUDULENT MANNER, OR AS A RESULT OF YOU BREAKING AN IMPORTANT TERM OR REPEATEDLY BREAKING ANY TERM IN THESE TERMS AND CONDITIONS.

• OUR COMPLIANCE WITH ANY APPLICABLE LAWS.

• LOSS OR CORRUPTION OF DATA UNLESS CAUSED BY OUR WILLFUL DEFAULT/WRONGDOING.

• A MERCHANT REFUSING TO ACCEPT YOUR CARD. OUR TOTAL LIABILITY UNDER OR IN CONNECTION WITH THE ACCOUNTS WHETHER ARISING IN CONTRACT, TORT, NEGLIGENCE, BREACH OF STATUTORY DUTY, LOSS OF PROFITS, LOSS OF BUSINESS, DEPLETION OF GOODWILL AND/OR SIMILAR LOSSES OR LOSS OF ANTICIPATED SAVINGS OR LOSS OF GOODS; OR LOSS OF CONTRACT OR LOSS OF USE OR CORRUPTION OF DATA OR INFORMATION OR ANY SPECIAL, INDIRECT, CONSEQUENTIAL OR PURE ECONOMIC LOSS, COSTS, DAMAGES, CHARGES OR EXPENSES ARISING HEREUNDER OR OTHERWISE HOWSOEVER, SHALL NOT EXCEED THE FEES RECEIVED BY US DURING THE LAST TWELVE MONTHS UNDER THESE TERMS AND CONDITIONS IN WHICH LIABILITY ARISES. From time to time, Your ability to use Your Account may be interrupted, e.g. when We carry out maintenance. If this happens, You may be unable to:

• Fund Your Accounts; and/or

• Wire funds; and/or

• Obtain information about the funds available in Your Accounts and/or about Your recent Transactions.

WHERE SUMS ARE INCORRECTLY DEDUCTED FROM YOUR ACCOUNT FUNDS BY US, OUR LIABILITY SHALL BE LIMITED TO PAYMENT TO YOU OF AN EQUIVALENT AMOUNT. IN ALL OTHER CIRCUMSTANCES OUR LIABILITY WILL BE LIMITED TO THE REPAYMENT OF THE AMOUNT OF THE FUNDS IN YOUR ACCOUNTS.

You agree to fully cooperate in the civil and criminal prosecution of anyone engaged in unauthorized use of Your Accounts, failure to cooperate will be deemed as the claimed unauthorized Transaction as being authorized by You and You shall be responsible to indemnify us for all expenses incurred during the investigation and resolution of Your claim. You shall indemnify us and keep indemnified from and against all liabilities, damages, losses and costs (including legal costs) duties, taxes, charges or commissions incurred or suffered by us in the proper performance of services on Your behalf or the enforcement of rights hereunder. We strive to maintain the accuracy of information posted on the services, We cannot and do not guarantee the accuracy, suitability, reliability, completeness, performance, or fitness for any purpose of the content made available through our services and will not be liable for any loss or damage that may arise directly or indirectly from Your use of such content. Information on our services can be subjected to change without notice and is provided for the primary purpose of facilitating users to arrive at independent decisions. We do not provide investment or advisory advice and will have no liability for the use or interpretation of information as stated on our services or other communication mediums.

SECTION 14: CANCELLATION, TERMINATION AND SUSPENSION

You may cancel Your currency Accounts, without reason, by contacting the Apex Card Services Member Support Team. We will require You to confirm Your wish to cancel in writing. This will not entitle You to a refund of any Transactions You have made (authorized or pending) or charges incurred in respect of such Transactions. Cancellation fee shall be incurred, which will be deducted from the balance of Your Account (see Fee Schedule).

To cancel Your Card, You must notify the Apex Card Services Member Support Team. Once We have been notified by You, We will block the Card immediately so it cannot be used. We will wait at least 21 days for all Transactions to be processed and settled before We refund the remaining balance of money to You. When Your Card is cancelled, You must destroy the chip and magnetic strip or return the Card to our address. You will be responsible for any Transaction You have made, or charges incurred before You cancelled Your Account. You may elect to Reactivate Your Account in the event You have lapsed on the monthly fee payments. To do, You may be required to pay a Reactivation fee (see Fee Schedule). We can suspend, restrict, cancel, or terminate this Agreement with You and Your use of Your Accounts immediately if: We are concerned about the security of Your Accounts.

• If We suspect or have reason to believe that You have used or intend to use the Account in a negligent manner or for fraudulent or other unlawful purposes. • If We can no longer process Your Transactions for any legal or security reason or due to actions of any third party or yourself.

• If You fail to pay any Fees in this Agreement or in Your Apex Card Services Membership Agreement, or charges that You have incurred or fail to repay any overspend incurred on Your Account.

• You do not comply with this Agreement, break an important part of this Agreement and/or the Apex Card Services Membership Agreement or repeatedly break any term in this Agreement and/or fail to resolve the matter in a timely manner.

• We discover that any information You have provided is incorrect or incomplete.

• We need to do so to comply with the law and law enforcement agencies from where We may be subject to; OR. For Convenience. If We take any of the steps referred to above in provision, We may tell You as soon as We can or are permitted to do so after We have taken such steps. We may also terminate the Apex Card Services Membership Agreement. We may ask You to stop using Your Account. We may reactivate Your Account if after further investigations We believe that the relevant circumstances no longer apply.

Fees may apply (see Fee Schedule). If any Transaction, fee, or charge is found to have been incurred using Your Account following cancellation or termination, You agree to pay all such sums to us immediately on demand. This Agreement will terminate in the event of Your death. If You die, We may require certain documentation necessary to certify the death or substantiate that a particular individual has been officially appointed as the administrator or executor of the applicable estate. You confirm that the administrator or executor of the applicable estate will have instructions to notify us in the event of the Account holder’s death and will provide us with the necessary certifications. If any of Your Accounts hold any outstanding balance after the termination of Your Membership, We will return the monies held in Your Accounts as soon as You notify us in written the instruction for such refund, subject to all applicable fees, our current policies, applicable laws, or any law enforcement agency instruction We may receive.

SECTION 15: PERSONAL DATA

All customer data is kept secure and complies to the principle of the General Data Protection Regulation (GDPR). We are committed to keeping Your personal data secure. We will not pass information We hold about You to any third party other than: (i) to our services providers that support the services rendered to You under this Agreement; (ii) to persons acting as our agents or partners under strict confidentiality obligations, (iii) to agencies and other organizations who may use or request Your information to prevent and detect fraud, money laundering, terrorist financing or other financial crimes. If We transfer information to a third party in a country outside of the European Economic Area (EEA), We will ensure that the third party agrees to apply the same levels of protection that We are legally obligated to maintain when We process personal data. You have a right to inspect the personal data We hold about You. You will be solely responsible for ensuring that the details You provide to us are true, complete, and accurate. We will collect and retain personal information about You so that We can operate Your Accounts and deal with any inquiries that You may have about it. As part of our checks to prevent fraud, money laundering, terrorist financing or other financial crime We may share personal information that You provide with credit reference or fraud prevention agencies. If We transfer Your information to a third party in a country outside of the European Economic Area, We will ensure that the third party agrees to apply the same levels of protection that We are legally obligated to maintain when We process personal data. If, when You apply for an Account, You opt in to receiving marketing information via email, mobile phone and do not opt out of receiving marketing information by telephone or mail, We and third parties with whom We may share Your personal data, may from time to time contact You about products or services that We or they think may be of interest to You. If You no longer wish to receive such communications, please contact the Apex Card Services Member Support team. If We suspect that We have been given false or inaccurate information, We may record and report suspicion together with any other relevant information. If false or inaccurate information is provided and fraud is identified, details will be passed to fraud prevention agencies to prevent fraud and money laundering and financing of terrorism. You have a right to inspect the personal data We hold about You. However, We may ask You to pay a fee of $55.00 to cover our administration costs. For further information please contact the Apex Card Services Member Support team. We may request additional information and documentation from You when necessary for us to comply with relevant legislation. You accept that We may record and store any telephone conversations which are made between You and us and that any such recording or transcript of telephone conversations is stored to help us improve our service, assist in resolving any dispute that may arise under this Agreement, comply with any laws or regulations, or help us detect or prevent fraud or other crimes. You must let us know as soon as possible if You change Your name, address, mobile phone number or e-mail address. If We contact You in relation to Your Account, for example, to notify You that We will be changing the Terms and Conditions or have cancelled Your Accounts and wish to send You a refund, We will use the most recent contact details You have provided to us. Any e-mail to You will be treated as being received as soon as it is sent by us. We will not be liable to You if Your contact details have changed, and You have not told us.

SECTION 16: CUSTOMER SERVICES

The Apex Card Services Member Support team is available 24 hours a day, 7 days a week. A Reporting Service is available 24 hours a day, 7 days a week. We may record any conversation or chat You have with the Apex Card Services Member Support team for training, compliance, and/or monitoring purposes. The Apex Card Services Member Support Team may be contacted in the following ways: Mobile Application: Refer to the “Contact Us” information in the mobile application Email: Support@apexcardservice.com for support enquiries / Complaints@apexcardservices.com for any complaints that You may have.

Phone: +82 704 784 4351 Post: 1 King William Street, London EC4N 7AF United Kingdom Attention:

Apex Card Services Member Support.

We aim to provide You with reasonable customer service. Yet sometimes things can go wrong. If this is the case, please let us know all Your concerns via our Apex Card Services Member Support team and We will work with You to find a solution to resolve Your issue. We will keep You updated throughout our investigation, and We will endeavor to resolve Your complaint. More complex situation may require further investigation, if this is the case, We will give You reasonable updates until We can provide You with a response. Under the Financial Ombudsman Service, the business is to provide a final response within eight weeks, depending on the nature of Your complaint. If You are unhappy with our response, You may contact the Financial Ombudsman Service by: Post Addressing Your complaint to the Financial Ombudsman Services, Exchange Tower, Harbour Exchange, London, E14 9SR United Kingdom Telephone – on +44 20 7964 0500. Online – https://help.financial-ombudsman.org.uk/help Please be aware that there are time limits after which the Financial Ombudsman Service may no longer be able to hear Your complaint. You can find further details of the service offered by the Financial Ombudsman Service at http://www.financialombudsman.org.uk/. You may also find their consumer leaflet with further information at http://www.financialombudsman.org.uk/publications/consumer-leaflet.htm

SECTION 17: MISCELLANEOUS

Headings: In this Agreement, headings are for convenience only and shall not affect the interpretation of this Agreement. Any delay or failure by us to exercise any right or remedy under this Agreement shall not be interpreted as a waiver of that right or remedy or stop us from exercising our rights at any subsequent time.

Assignability:

You may not novate, assign, or transfer any rights and/or benefits under this Agreement. We may assign, transfer, or novate our rights and benefits and obligations at any time without prior written notice to You. If You do not want to transfer to the new Account Issuer You may contact Us and We will terminate Your Account. Any balance remaining in Your Account will be returned to You in accordance with our redemption procedure. We may subcontract any of our obligations under this Agreement.

Severability:

In the event that any part of this Agreement is held not to be enforceable, this shall not affect the remainder of this Agreement which shall remain in full force and effect. We reserve the right to include a substitute provision to the aforementioned part or provision that to the extent possible is (1) valid and enforceable and (2) accomplishes the original business purpose. You will remain responsible for complying with this Agreement until Your Account is closed (for whatever reason) and all sums due under this Agreement have been paid in full.

Language:

This Agreement is written and available in English and all correspondence with You in respect of Your Account(s) shall be in English. In the event that this Agreement are translated, the version in English shall take priority.

Non-Waiver.

No delay or failure on our part in exercising any right hereunder shall operate as a waiver of any of our rights, as the case may be, except to the extent specifically waived in writing.

Disputes:

This Agreement is governed by the laws of England and Wales. The exclusive venue for all disputes shall be decided in England. Any dispute or difference arising out of or in connection with this contract shall be determined by the appointment of a single arbitrator to be agreed between the parties, or failing agreement within fourteen days, the parties hereby agree that the dispute shall be referred to and finally resolved by arbitration under the LCIA Rules. Either party agrees to provide a 30-day written notice of dispute. Both parties in this Agreement will split the cost to initiate a dispute through arbitration. The prevailing party shall have the right to collect from the other party its reasonable costs, including but not limited to attorneys’ fees and expert witnesses.

YOU IRREVOCABLY WAIVE TO THE FULLEST EXTENT PERMITTED BY LAW ANY OBJECTION THAT YOU MAY HAVE OR HEREAFTER HAVE TO THE LAYING OF THE VENUE INCLUDED IN THIS CLAUSE, AND ANY CLAIM THAT ANY SUCH ACTION OR PROCEEDING BROUGHT HAS BEEN BROUGHT IN AN INCONVENIENT FORUM. NO CLAIM ARISING OUT OF THE AGREEMENT, REGARDLESS OF FORM, MAY BE BROUGHT MORE THAN THE SHORTER OF SIX MONTHS OR THE MINIMUM PERIOD ALLOWED BY LAW AFTER THE CAUSE OF ACTION HAS OCCURRED. YOU AGREE AND UNDERSTAND THAT YOU AND We ARE GIVING UP: (I) THE RIGHT TO TRIAL BY JURY; (II) THE RIGHT TO PARTICIPATE IN OR BE REPRESENTED IN ANY FORM OF CLASS ACTION INCLUDING BUT WITHOUT LIMITATION ANY CLASS ARBITRATION (“CLASS ACTION WAIVER”). IN THE EVENT THAT THE CLASS ACTION WAIVER IS INCONSISTENT WITH THE RULES OF ANY TRIBUNAL OR OTHER SUCH ARBITRATION BODY, YOU AND We AGREE NOT TO FILE PROCEEDINGS WITH SUCH BODY; (III) THE RIGHT TO JOIN ANY CLAIM WITH THE CLAIM OF ANY OTHER PERSON OR ENTITY IN A LAWSUIT, ARBITRATION OR OTHER SUCH PROCEEDING; (IV) THE RIGHT TO RESOLVE ANY CLAIM THAT EITHER OF US HAS AGAINST THE OTHER ON A CLASS WIDE BASIS; AND (V) THE RIGHT TO ASSERT A CLAIM IN A REPRESENTATIVE CAPACITY ON BEHALF OF ANYONE ELSE AND, FOR THE AVOIDANCE OF DOUBT, IF FOR ANY REASON THIS PART (V) IS DETERMINED TO BE INVALID OR UNENFORCEABLE, ALL SUCH CLAIMS WILL BE BROUGHT IN COURT AND SHALL NOT RESOLVED THROUGH ARBITRATION.

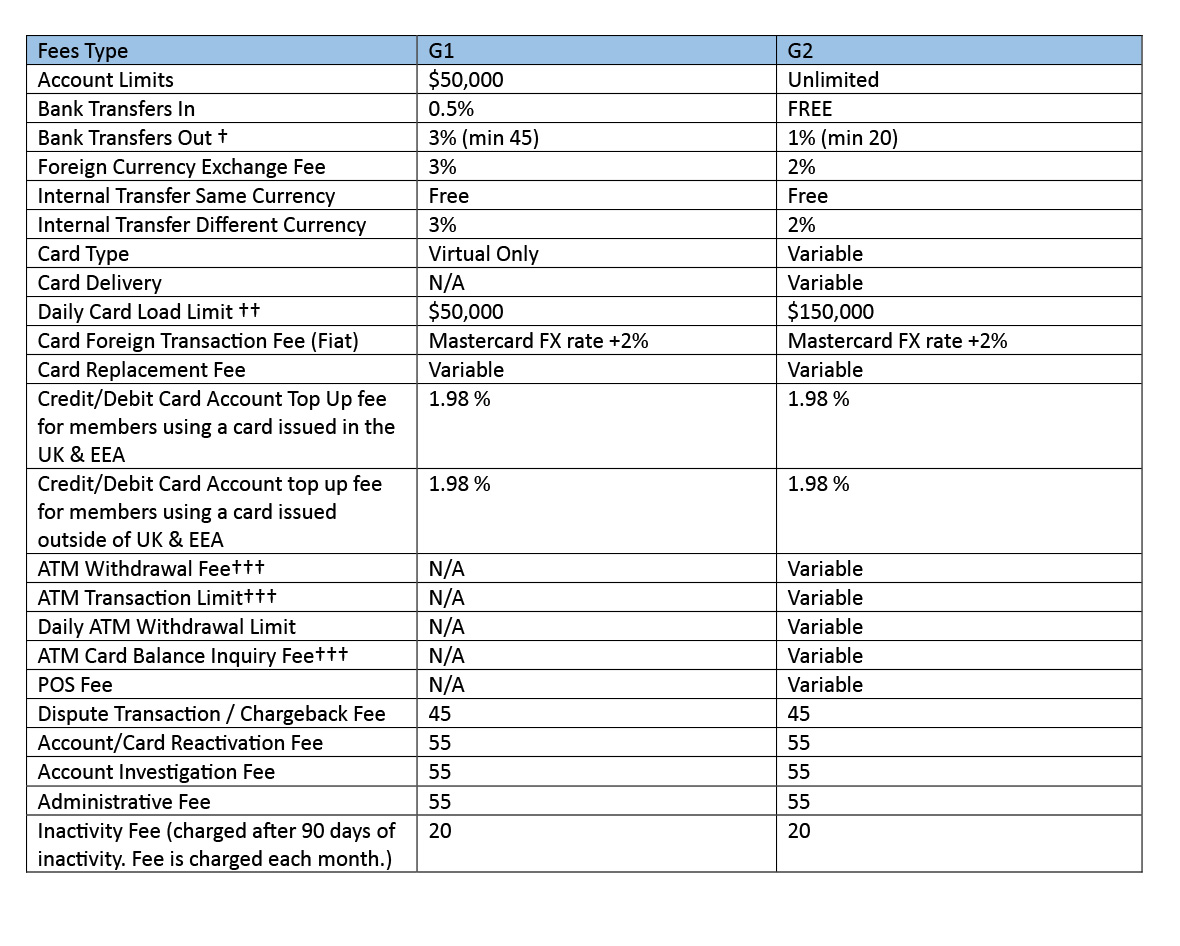

SCHEDULE 1

YOU IRREVOCABLY WAIVE TO THE FULLEST EXTENT PERMITTED BY LAW ANY OBJECTION THAT YOU MAY HAVE OR HEREAFTER HAVE TO THE LAYING OF THE VENUE INCLUDED IN THIS CLAUSE, AND ANY CLAIM THAT ANY SUCH ACTION OR PROCEEDING BROUGHT HAS BEEN BROUGHT IN AN INCONVENIENT FORUM. NO CLAIM ARISING OUT OF THE AGREEMENT, REGARDLESS OF FORM, MAY BE BROUGHT MORE THAN THE SHORTER OF SIX MONTHS OR THE MINIMUM PERIOD ALLOWED BY LAW AFTER THE CAUSE OF ACTION HAS OCCURRED. YOU AGREE AND UNDERSTAND THAT YOU AND We ARE GIVING UP: (I) THE RIGHT TO TRIAL BY JURY; (II) THE RIGHT TO PARTICIPATE IN OR BE REPRESENTED IN ANY FORM OF CLASS ACTION INCLUDING BUT WITHOUT LIMITATION ANY CLASS ARBITRATION (“CLASS ACTION WAIVER”). IN THE EVENT THAT THE CLASS ACTION WAIVER IS INCONSISTENT WITH THE RULES OF ANY TRIBUNAL OR OTHER SUCH ARBITRATION BODY, YOU AND We AGREE NOT TO FILE PROCEEDINGS WITH SUCH BODY; (III) THE RIGHT TO JOIN ANY CLAIM WITH THE CLAIM OF ANY OTHER PERSON OR ENTITY IN A LAWSUIT, ARBITRATION OR OTHER SUCH PROCEEDING; (IV) THE RIGHT TO RESOLVE ANY CLAIM THAT EITHER OF US HAS AGAINST THE OTHER ON A CLASS WIDE BASIS; AND (V) THE RIGHT TO ASSERT A CLAIM IN A REPRESENTATIVE CAPACITY ON BEHALF OF ANYONE ELSE AND, FOR THE AVOIDANCE OF DOUBT, IF FOR ANY REASON THIS PART (V) IS DETERMINED TO BE INVALID OR UNENFORCEABLE, ALL SUCH CLAIMS WILL BE BROUGHT IN COURT AND SHALL NOT RESOLVED THROUGH ARBITRATION.

PLEASE NOTE

† All wire transfers are subject to applicable laws and originating/receiving bank restrictions and fees, †† Transaction limits may apply.

††† If You use an ATM not owned by us for any Transaction, including a balance inquiry, You may be charged a fee by the ATM operator even if You do not complete a withdrawal. If You obtain cash from a bank teller, the bank may charge a fee. This ATM fee or bank fee is a third-party fee amount assessed by the individual ATM operator or bank only and is not assessed nor controlled by us. This ATM fee or bank fee amount will be charged to Your Card. Note – Nvayo or its affiliates may receive a portion of Card fees and/or interchange fees.

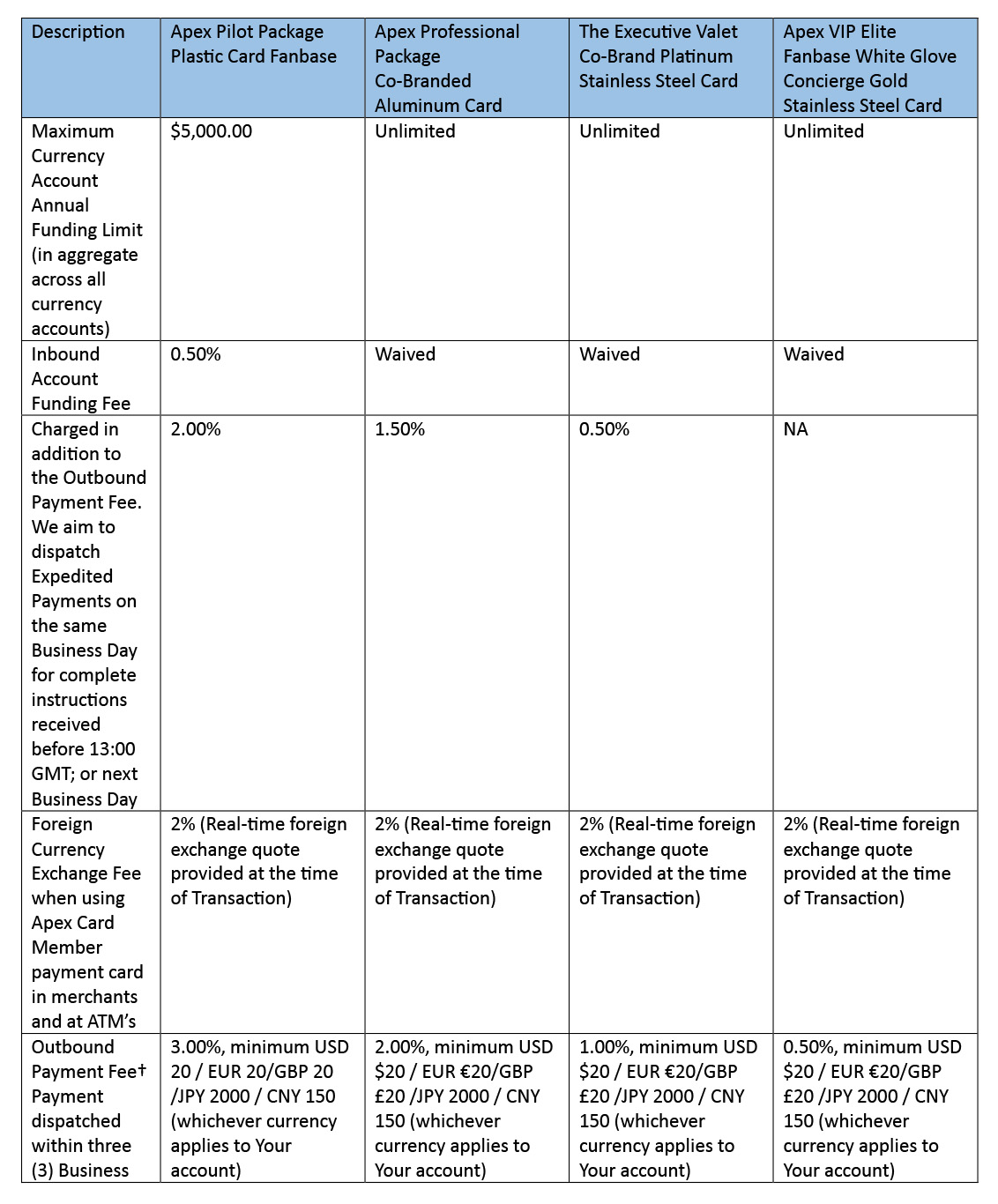

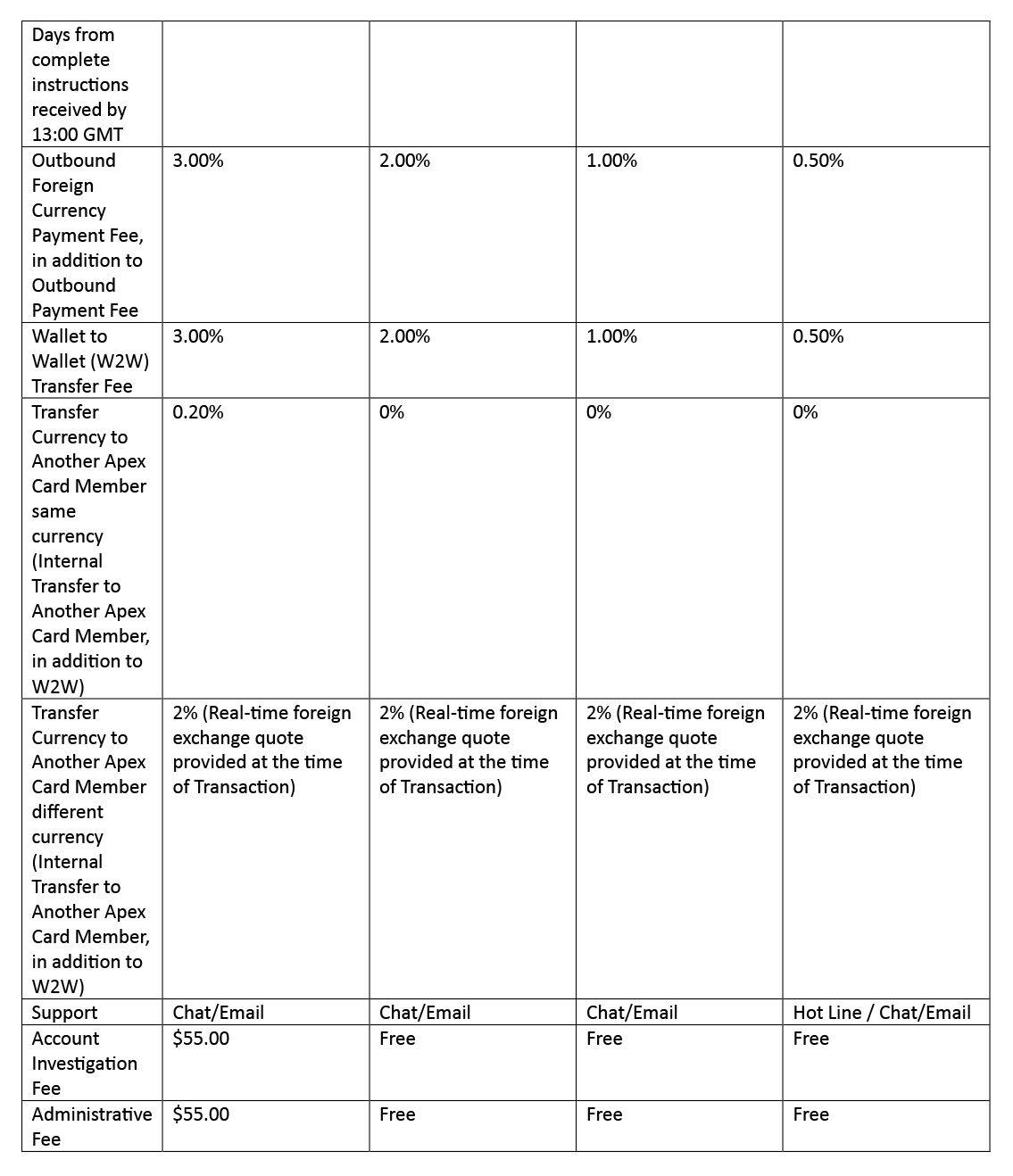

SCHEDULE 2

Fee Table

† All wire transfers are subject to applicable laws and originating/receiving bank restrictions and fees. †† Transaction limits may apply.

††† If You use an ATM not owned by us for any Transaction, including a balance inquiry, You may be charged a fee by the ATM operator even if You do not complete a withdrawal. If You obtain cash from a bank teller, the bank may charge a fee. This ATM fee or bank fee is a third-party fee amount assessed by the individual ATM operator or bank only and is not assessed nor controlled by us. This ATM fee or bank fee amount will be charged to Your Card. Note – ZenChip PRIME Corp., Apex Card Services, Nvayo or its affiliates may receive a portion of Card fees and/or interchange fees. Apex Card Services, LLC. is not a wallet provider, exchange, broker, financial institution, money services business, or creditor. Apex Card Services, LLC. provides a peer-to-peer web3 service that helps users discover and directly interact with each other and NFTs available on public blockchains. We do not have custody or control over the NFTs or blockchains you are interacting with, and we do not execute or effectuate purchases, transfers, or sales of NFTs. To use our Service, you must use a third-party wallet which allows you to engage in transactions on blockchains. Apex Card Services, LLC. is not party to any agreement between any users. You bear full responsibility for verifying the identity, legitimacy, and authenticity of NFTs that you purchase from third-party sellers using the Service and we make no claims about the identity, legitimacy, functionality, or authenticity of users or NFTs (and any content associated with such NFTs) visible on the Service. Because we have a growing number of services, we sometimes need to provide additional terms for specific services (and such services are deemed part of the “Service” hereunder and shall also be subject to these Terms). Those additional terms and conditions, which are available with the relevant service, then become part of your agreement with us if you use those services. In the event of a conflict between these Terms and any additional applicable terms we may provide for a specific service, such additional terms shall control for that specific service. Apex Card Services, LLC. reserves the right to change or modify these Terms at any time and in our sole discretion. If we make material changes to these Terms, we will use reasonable efforts to provide notice of such changes, such as by providing notice through the Service or updating the “Last Updated” date at the beginning of these Terms. By continuing to access or use the Service, you confirm your acceptance of the revised Terms and all of the terms incorporated therein by reference effective as of the date these Terms are updated. It is your sole responsibility to review the Terms from time to time to view such changes and to ensure that you understand the terms and conditions that apply when you access or use the Service.

Accessing The Card Service

Like much of web3, your blockchain address functions as your identity on Apex Card Services, LLC. Accordingly, you will need a blockchain address and a third-party wallet to access the Service. Your account on the service (“Account”) will be associated with your blockchain address; however, if you want to add some flair to your Apex Card Services, LLC. persona, you can add additional information, such as a profile picture, to your Account. Your Account on Apex Card Services, LLC. will be associated with your linked blockchain address and display the NFTs for that blockchain address (and, if applicable, any content associated with such NFTs). By using your wallet in connection with the Service, you agree that you are using that wallet under the terms and conditions of the applicable provider of the wallet. Wallets are not operated by, maintained by, or affiliated with Apex Card Services, LLC., and Apex Card Services, LLC. does not have custody or control over the contents of your wallet and has no ability to retrieve or transfer its contents. Apex Card Services, LLC. accepts no responsibility for, or liability to you, in connection with your use of a wallet and makes no representations or warranties regarding how the Service will operate with any specific wallet. You are solely responsible for keeping your wallet secure and you should never share your wallet credentials or seed phrase with anyone. If you discover an issue related to your wallet, please contact your wallet provider. Likewise, you are solely responsible for your Account and any associated wallet, and we are not liable for any acts or omissions by you in connection with your Account or as a result of your Account or wallet being compromised. You agree to immediately notify us if you discover or otherwise suspect any security issues related to the Service or your Account (you can contact us here). You also represent and warrant that you will comply with all applicable laws (e.g., local, state, federal and other laws) when using the Service. Without limiting the foregoing, by using the Service, you represent and warrant that: (a) you are not located in, ordinarily resident in, or organized under the laws of any jurisdiction that is subject to a comprehensive U.S. Government embargo ("Embargoed Jurisdiction"); (b) you are not subject to any sanctions administered by an agency of the U.S. Government, any other government, or the United Nations (collectively, “Sanctions”); (c) you are not owned or controlled, directly or indirectly, by any person that is subject to Sanctions, or that is located in, ordinarily resident in, or organized under the laws of, any Embargoed Jurisdiction; (d) none of your officers, managers, directors, shareholders or authorized representatives is subject to Sanctions, or is located in, ordinarily resident in, or organized under the laws of, any Embargoed Jurisdiction, or is owned or controlled, directly or indirectly, by any person that is subject to Sanctions or that is located in, ordinarily resident in, or organized under the laws of, any Embargoed Jurisdiction. You further covenant that the foregoing shall be true during the entire period of this agreement. If you access or use the Service outside the United States, you are solely responsible for ensuring that your access and use of the Service in such country, territory or jurisdiction does not violate any applicable laws. Apex Card Services, LLC. may require you to provide additional information and documents in certain circumstances, such as at the request of any government authority, as any applicable law or regulation dictates, or to investigate a potential violation of these Terms. In such cases, Apex Card Services, LLC., in its sole discretion, may disable your Account and block your ability to access the Service until such additional information and documents are processed by Apex Card Services, LLC. If you do not provide complete and accurate information in response to such a request, Apex Card Services, LLC. may refuse to restore your access to the Service. Your access and use of the Service may be interrupted from time to time for any of several reasons, including, without limitation, the malfunction of equipment, periodic updating, maintenance, or repair of the Service or other actions that Apex Card Services, LLC., in its sole discretion, may elect to take. If your Account becomes inactive for six months or longer, as determined by Apex Card Services, LLC. in its sole discretion, you understand that Apex Card Services, LLC. may disable your Account or reassign your username or associated URL. We require all users to be at least 18 years old. If you are at least 13 years old but under 18 years old, you may only use Apex Card Services, LLC. through a parent or guardian’s Account and with their approval and oversight. That account holder is responsible for your actions using the Account. It is prohibited to use our Service if you are under 13 years old.

Ownership

The Apex Card Service, including its “look and feel” (e.g., text, graphics, images, logos, page headers, button icons, and scripts), proprietary content, information and other materials, and all content and other materials contained therein, including, without limitation, the Apex Card Services, LLC. logo and all designs, text, graphics, pictures, data, software, sound files, other files, and the selection and arrangement thereof are the proprietary property of Apex Card Services, LLC. or our affiliates, licensors, or users, as applicable, and you agree not to take any action(s) inconsistent with such ownership interests. We and our affiliates, licensors, and users, as applicable, reserve all rights in connection with the Service and its content, including, without limitation, the exclusive right to create derivative works. Apex Card Services, LLC.’s name, logo, trademarks, and any Apex Card Services, LLC. product or service names, designs, logos, and slogans are the intellectual property of Apex Card Services, LLC. or our affiliates or licensors and may not be copied, imitated, or used, in whole or in part, without our prior written permission in each instance. You may not use any metatags or other “hidden text” or any other name, trademark or product or service name of Apex Card Services, LLC. or our affiliates or licensors without our prior written permission. In addition, the “look and feel” of the Service constitutes the service mark, trademark or trade dress of Apex Card Services, LLC. and may not be copied, imitated or used, in whole or in part, without our prior written permission. All other third-party trademarks, registered trademarks, and product names mentioned on the Service or contained in the content linked to or associated with any NFTs displayed on the Service are the property of their respective owners and may not be copied, imitated, or used, in whole or in part, without the permission of the applicable intellectual property rights holder. Reference to any products, services, processes or other information by name, trademark, manufacturer, supplier or otherwise does not constitute or imply endorsement, sponsorship, or recommendation by Apex Card Services, LLC. We welcome feedback, comments, and suggestions for improvements to the Service (“Feedback”). You acknowledge and expressly agree that any contribution of Feedback does not and will not give or grant you any right, title, or interest in the Service or in any such Feedback. You agree that Apex Card Services, LLC. may use and disclose Feedback in any manner and for any purpose whatsoever without further notice or compensation to you and without retention by you of any proprietary or other right or claim. You hereby assign to Apex Card Services, LLC. any and all right, title, and interest (including, but not limited to, any patent, copyright, trade secret, trademark, show-how, know-how, moral rights and any and all other intellectual property right) that you may have in and to any and all Feedback.

License to Access and Use Our Service and Content

You are hereby granted a limited, nonexclusive, nontransferable, nonsublicensable, and personal license to access and use the Service provided, however, that such license is subject to your compliance with these Terms. If any software, content, or other materials owned by, controlled by, or licensed to us are distributed or made available to you as part of your use of the Service, we hereby grant you a non-commercial, personal, non-assignable, non-sublicensable, non-transferrable, and non-exclusive right and license to access and display such software, content, and materials provided to you as part of the Service (and right to download a single copy of the App onto your applicable equipment or device), in each case for the sole purpose of enabling you to use the Service as permitted by these Terms, provided that your license in any content linked to or associated with any NFTs is solely as set forth by the applicable seller or creator of such NFT.

Third-Party Content and Services

As a peer-to-peer web3 service, Apex Card Services, LLC. helps you explore NFTs created by third parties and interact with different blockchains. Apex Card Services, LLC. does not make any representations or warranties about this third-party content visible through our Service, including any content associated with NFTs displayed on the Service, and you bear responsibility for verifying the legitimacy, authenticity, and legality of NFTs that you purchase from third-party sellers. We also cannot guarantee that any NFTs are visible on Apex Card Services, LLC. will always remain visible and/or available to be bought, sold, or transferred. NFTs may be subject to terms directly between buyers and sellers with respect to the use of the NFT content and benefits associated with a given NFT (“Purchase Terms”). For example, when you click to get more details about any of the NFTs visible on Apex Card Services, LLC., you may notice a third party link to the creator’s website. Such a website may include Purchase Terms governing the use of the NFT that you will be required to comply with. Apex Card Services, LLC. is not a party to any such Purchase Terms, which are solely between the buyer and the seller. The buyer and seller are entirely responsible for communicating, promulgating, agreeing to, and enforcing Purchase Terms. You are solely responsible for reviewing such Purchase Terms. The Service may also contain links or functionality to access or use third-party websites (“Third-Party Websites”) and applications (“Third-Party Applications”), or otherwise display, include, or make available content, data, information, services, applications, or materials from third parties (“Third-Party Materials”). When you click on a link to, or access and use, a Third-Party Website or Third-Party Application, though we may not warn you that you have left our Service, you are subject to the terms and conditions (including privacy policies) of another website or destination. Such Third-Party Websites, Third-Party Applications, and Third-Party Materials are not under the control of Apex Card Services, LLC., and may be “open” applications for which no recourse is possible. Apex Card Services, LLC. is not responsible or liable for any Third-Party Websites, Third-Party Applications, or Third-Party Materials. Apex Card Services, LLC. provides links to these Third-Party Websites and Third-Party Applications only as a convenience and does not review, approve, monitor, endorse, warrant, or make any representations with respect to Third-Party Websites or Third-Party Applications, or their products or services or associated Third-Party Materials. You use all links in Third-Party Websites, Third-Party Applications, and Third-Party Materials at your own risk.

User Conduct

Transparency is one of our most prized values, and we’re committed to providing people from all walks of life and varying experience levels with web3 with a colorful lens into different blockchains. However, to protect our community and comply with our legal obligations, we reserve the right to act, with or without advance notice, if we believe you have violated these Terms. This may include removing the ability to view certain NFT's on the Service or use our Service to interact with the NFTs; disabling the ability to use the Service in conjunction with buying/selling/transferring NFTs available on blockchains; disabling your ability to access our Service; and/or other actions.

You Agree

That you will not violate any law, contract, intellectual property, or other third-party rights, and that you are solely responsible for your conduct and content while accessing or using the Service. You also agree that you will not:

• Use or attempt to use another user’s Account without authorization from such user.

• Pose as another person or entity or use a wallet to engage in a transaction on Apex Card Services, LLC. that is owned or controlled, in whole or in part, by any other person.

• Claim an Apex Card Services, LLC. username for the purpose of reselling it, confusing others, deriving others’ goodwill, or otherwise engage in name squatting.

• The squatting service from a different blockchain address if we’ve blocked any of your other blockchain addresses from accessing the Service unless you have our written permission first.

• Distribute spam, including through sending unwanted NFTs to other users.

• Use the Service – including through disseminating any software or interacting with any API – that could damage, disable, overburden, or impair the functioning of the Service in any manner.

• Bypass or ignore instructions that control access to the Service, including attempting to circumvent any rate limiting systems by using multiple API keys, directing traffic through multiple IP addresses, or otherwise obfuscating the source of traffic you send to Apex Card Services, LLC.

• Use our Service for commercial purposes inconsistent with these Terms or any other instructions.

• Use any data mining, robot, spider, crawler, scraper, script, browser extension, offline reader, or other automated means or interface not authorized by us to access the Service, extract data, or otherwise interfere with or modify the rendering of Service pages or functionality.

• Reverse engineer, duplicate, decompile, disassemble, or decode any aspect of the Service, or do anything that might discover source code or bypass or circumvent measures employed to prevent or limit access to any service, area, or code of the Service.

• Sell or Re -Sell the Service or attempt to circumvent any Apex Card Services, LLC. fee systems.

• Engage in behaviors that have the intention or systems. Ct of artificially causing an item or collection to appear at the top of search results, or artificially increasing view counts, favorites, or other metrics that Apex Card Services, LLC. might use to sort search results.

• Use the Service or data collected from our Service for any advertising or direct marketing activity (including without limitation, email marketing, SMS marketing, and telemarketing);

• Use the Service results connection with money laundering, terrorist financing, or other illicit financial activity, or in any way in connection with the violation of any law or regulation that applies to you or to Apex Card Services, LLC.

• Use the Service. Directly or indirectly, for, on behalf of, or for the benefit of, (a) any natural or legal person that is the subject of Sanctions; (b) any natural or legal person located in, ordinarily resident in, or organized under the laws of, any Embargoed Jurisdiction; or (c) any legal person owned or controlled, directly or indirectly, by any natural or legal person located in, ordinarily resident in, or organized under the laws of, any Embargoed Jurisdiction.

• Use the Service to carry out any financial activities subject to registration or licensing, including but not limited to creating, offering, selling, or buying securities, commodities, options, or debt instruments.

• Use the Service to create, sell, or buy NFTs or other items that give owners’ rights to participate in an ICO or any securities offering, or that are redeemable for securities, commodities, or other financial instruments.

• Use the Service to engage in price manipulation, fraud, or other deceptive, misleading, or manipulative activity.

• Use the Service to buy, sell, or transfer stolen items, fraudulently obtained items, items taken without authorization, and/or any other illegally obtained items.

• Infringe or violate the intellectual property rights or any other rights of others.

• Create or display illegal content, such as content that may involve child sexual exploitation.

• Create or display NFT's or other items that promote suicide or self-harm, incites hate or violence against others, or doxes another individual.

• Use the Service for any illegal or unauthorized purpose, including creating or displaying illegal content, such as content that may involve child sexual exploitation, or encouraging or promoting any activity that violates the Terms of Service.

• Use the Service in any manner that could interfere with, disrupt, negatively affect, or inhibit other users from fully enjoying the Service. We allow users to post NSFW content, but that content and other associated material is subject to being marked NSFW and may be handled differently than non-NSFW content in navigation menus and search results. Finally, by using the Service, you understand the importance of DYOR – doing your own research. You bear full responsibility for verifying the authenticity, legitimacy, identity, and other details about any NFT, collection, or account that you view or otherwise interact with in conjunction with our Service. We make no guarantees or promises about the identity, legitimacy, or authenticity of any NFT, collection, or account on the Service.

Intellectual Property Rights

You are solely responsible for your use of the Service and for any information you provide, including compliance with applicable laws, rules, and regulations, as well as these Terms, including the User Conduct requirements outlined above. By using the Service in conjunction with creating, submitting, posting, promoting, or displaying content, or by complying with Apex Card Services, LLC.’s metadata standards in your metadata API responses, you grant us a worldwide, non-exclusive, sublicensable, royalty-free license to use, copy, modify, and display any content, including but not limited to text, materials, images, files, communications, comments, feedback, suggestions, ideas, concepts, questions, data, or otherwise, that you submit or post on or through the Service for our current and future business purposes, including to provide, promote, and improve the Service. This includes any digital file, art, or other material linked to or associated with any NFTs that are displayed on the Service. Apex Card Services, LLC. does not claim that submitting, posting, or displaying this content on or through the Service gives Apex Card Services, LLC. any ownership of the content. We're not saying we own it. We're just saying we might use it and show it off a bit. You represent and warrant that you have, or have obtained, all rights, licenses, consents, permissions, power and/or authority necessary to grant the rights granted herein for any content that you create, submit, post, promote, or display on or through the Service. You represent and warrant that such content does not contain material subject to copyright, trademark, publicity rights, or other intellectual property rights, unless you have necessary permission or are otherwise legally entitled to post the material and to grant Apex Card Services, LLC. the license described above, and that the content does not violate any laws. Apex Card Services, LLC. will take down works in response to Digital Millennium Copyright Act (“DMCA”) takedown notices and/or other intellectual property infringement claims and will terminate a user's access to the Service if the user is determined to be a repeat infringer. If you believe that your content has been copied in a way that constitutes copyright or trademark infringement, or violates your publicity or other intellectual property rights, please fill out our form here or you may submit written notice to our designated copyright agent at:

ZenChip PRIME Corp. Attn: Legal Department 207 West Plant St. # 770984 Winter Garden, FL 34777

Email: legal@Apexcardcervice.com

Phone: +1 (321) 201-6865 For us to process your infringement claim regarding content on the Service, you must be the rightsholder or someone authorized to act on behalf of the rightsholder. We encourage you to use our form to help ensure the requisite information is included in your notice. If you choose to write to us by e-mail or physical mail instead, your notice must include: Identification of the copyrighted work(s), trademark, publicity rights, or other intellectual property rights that you claim is being infringed. Identification of the allegedly infringing material that is requested to be removed, including a description of the specific location (i.e., urls) on the Service of the material claimed to be infringing, so that we may locate the material. Your contact information – at a minimum, your full legal name (not pseudonym) and email address.

A Declaration That Contains All of The Following:

• A statement that you have a good faith belief that use of the material in the manner complained of is not authorized by the intellectual property rights owner, its agent, or the law.